Senior Tax Advisor

If you owe federal taxes but do not think that you can pay them in a reasonable timeframe, you may be able to apply for “currently not collectible”, or CNC, status. This status prevents the IRS from taking certain collection actions against you. Here’s why you should consider applying for CNC status if you owe taxes but are unsure what to do next.

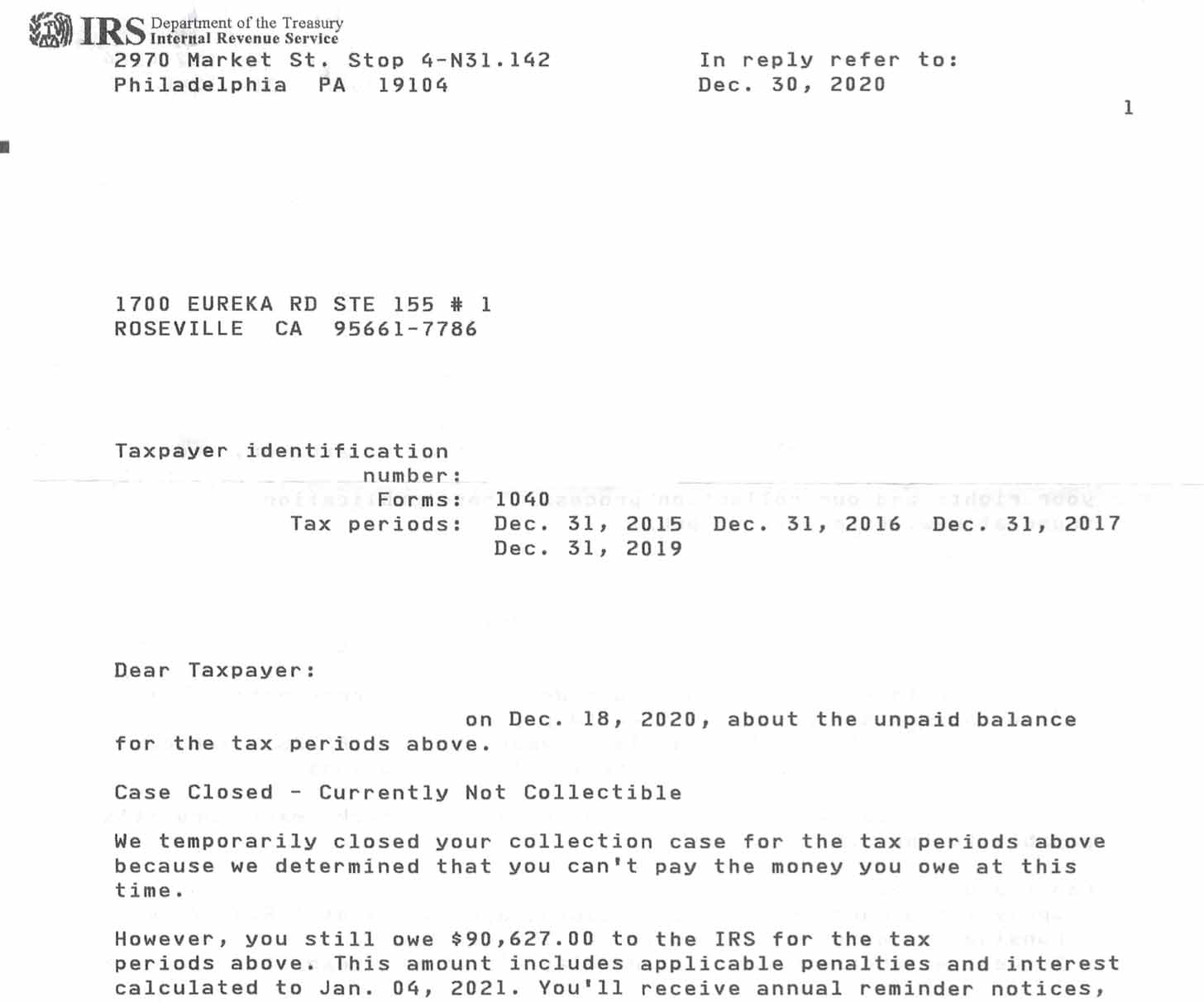

Tax Shark helps delinquent taxpayers get into compliance with the IRS with “Currently Not Collectible” and other tax resolution options.

If you want to receive a currently not collectible approval letter as our many clients do, contact us to discuss your options.

If your account with the IRS is marked as currently not collectible, it means that basic collection actions have been stalled. If your request for CNC status is approved, it means that the IRS will not enforce collections such as sending you notices that you owe taxes or escalating an existing case.

Going into currently not collectible status prevents the IRS from purposely going after taxpayers who do not have the ability to pay what they owe right away. This allows you more time to organize your finances and the IRS can focus their resources on taxpayers who are more likely to make payments faster.

The chief benefit of going into currently not collectible status is peace of mind. While you will still owe taxes, more drastic collection actions such as wage garnishment will not occur and thus worsen any financial issues you may be experiencing.

This makes currently not collectible status the best option if you owe taxes and experience a sudden decrease in income or other hardship, are unable to make payments on your balance due, and need time to figure out your payment and/or tax resolution options.

The IRS ultimately determines your eligibility on a case by case basis. There are certain hardships where the IRS may approve you for CNC status in as soon as two weeks, such as:

CNC status also tends to be fast-tracked if your only income is Social Security benefits, public assistance, or unemployment. If you are unemployed, unemployment benefits must be your only source of income. If you are considering self-employment or other sources of income, you may need to prove they do not provide enough to live on and pay for basic living expenses that meet IRS guidelines.

Depending on the circumstances of your situation and tax filing history with the IRS, you may be requested to submit information about your income, assets, and expenses. If your income was historically on the high side, the IRS may be less inclined to believe that you currently lack the assets to pay your tax debt in full or commence a payment plan. If you’ve experienced loss of income due to COVID-19 or other reasonable causes, documenting how long you have gone with little or no income can prove your case, especially if you are uncertain about when you are likely to have a livable income again.

If the IRS requests documentation of your monthly expenses, you need to prove that you do not have sufficient income left over after paying for basic necessities such as rent or mortgage payments, utilities, and food expenses for yourself and your dependents. For example, if the average rent for a two-bedroom apartment in your region is $2,000 but your rent is $3,000 per month for the same size, the IRS will only allow $2,000 to be considered in your affordability calculation.

If the IRS denies your request for CNC status upon examining your income, assets, and monthly expenses, you have the right to appeal their decision. Common reasons for denial are reporting higher income in prior tax years, but most often due to not having backdated tax returns filed.

Becoming currently not collectible buys more time if you cannot pay your outstanding taxes, often due to a hardship or other sudden change in financial circumstances. While CNC status can give you peace of mind that the IRS will not take egregious collection actions while you simply need more time or are trying to figure out your tax resolution options, it is not completely failsafe.

First, interest and relevant penalties will still be charged and it does not completely remove your tax debt. If you have determined that you will not be able to pay your taxes at all, you may need to consider a more drastic and permanent tax resolution option like an offer in compromise.

Other risks of making your account not collectible include:

To request that the IRS make your account currently not collectible, your tax professional can contact them on your behalf or you can call 1-800-829-1040 although wait times may be an hour or longer. If you received a notice about your balance due, you should reference it when you speak to the IRS representative.

You will need to describe your situation to the representative and why they cannot reasonably expect a tax payment from you. If your request is not fast-tracked due to falling into the previously discussed categories, you may need to submit information about your financial situation and wait for the IRS to make a decision.

First, a lien has to be placed on your property or income. The IRS files a public document called a federal tax lien if you have neglected your delinquent taxes and not taken any effort to pay them or notify the IRS of your situation.

A lien simply gives the IRS the right to lay claim to your property. A levy is when the actual seizure process begins.

Simply having unpaid tax bills or making your payments late will not cause a federal tax lien to erupt. If the IRS sees that you are making good faith efforts to pay your balance due, they will send you automated notices of your balance and apply any tax refunds from future years towards your balance but otherwise not take any collection actions.

However, if you have not made payments or any actions to take control of the situation like going on a payment plan, it can take a few months or even years of inaction before a lien appears.

If the lien placement still does not cause your tax debt to be repaid or arrangements to be made, the IRS can levy your income and/or assets. You are given a final notice, the CP-90 notice, of intent to levy your property and you have 30 days to respond and appeal the IRS’ decision. Once the 30 days are up, the seizure process begins.

If you owe $52,000 or more in tax debt, the IRS can alert the State Department to revoke your passport. As of 2019, more than 100,000 taxpayers have had their passports revoked.

Unpaid taxes can be a major stressor and you don’t want to ignore IRS notices. If you’re at risk for a tax lien or passport revocation, Tax Shark can help you request CNC status and figure out your other tax relief options. Contact us today to set up your free consultation.